Should You Take Advantage of Your Home Office Deduction?

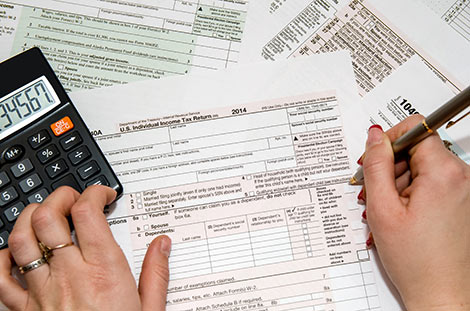

When you run your own small business and work from home, you have a few distinct advantages during tax season. Self-employed individuals are able to deduct a long list of business expenses, which can help decrease your overall taxable income. One of the most lucrative opportunities for small business owners allows you to deduct the [...]